🛡 Powerful Protection Spells That Shield From Harm

Safeguard yourself, loved ones, and your home from negative energy and spiritual threats with effective, trusted protection spells.

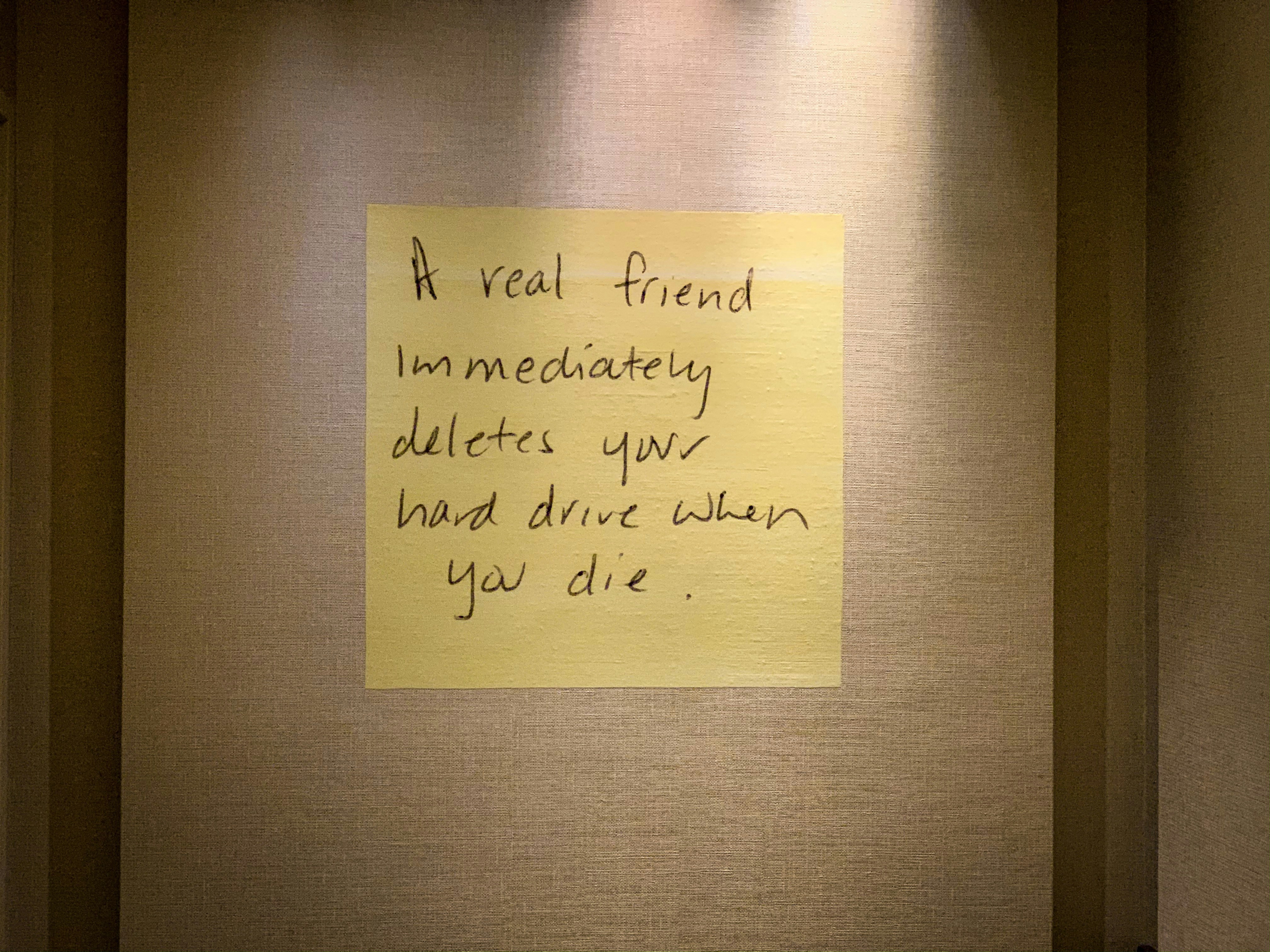

Introduction to Digital Afterlife

The concept of a digital afterlife pertains to the ongoing presence of an individual’s digital footprint following their death. In today’s hyper-connected world, the cumulative information that a person generates—from social media profiles to online purchases—has become a significant component of their identity. As we increasingly live our lives online, the data we leave behind continues to exist, raising essential questions about digital legacy and data management after one’s passing.

The volumes of data produced on digital platforms are unprecedented; each click, post, and transaction creates a persistent record. This accumulation has made it crucial for individuals to consider what happens to their information once they are no longer around. The term “digital afterlife” encompasses not only the preservation of one’s accounts and data but also the potential impact this digital legacy may have on family, friends, and even future generations. Issues such as privacy, security, and the ethical treatment of personal data are paramount in this discussion, as heirs may encounter complexities when administering or managing a deceased person’s digital assets.

Understanding Digital Footprints

In today’s interconnected world, a digital footprint is an inevitable aspect of life. It refers to the trail of data that individuals leave behind through their online activities. This encompasses a wide array of actions, including social media interactions, email communications, internet browsing habits, and file storage, among others. Each time a user engages with the digital landscape, whether by posting a photo on a social media platform, sending an email, or simply visiting a website, they are contributing to their digital footprint.

There are two primary types of digital footprints: passive and active. A passive digital footprint is the data collected about an individual without their knowledge, often through tracking technologies such as cookies. This data can include information on browsing habits, geographic location, and even user preferences. Conversely, an active digital footprint consists of the deliberate actions taken by an individual online. This includes contributions to social media forums, blog posts, comments, and any content that the user intentionally shares with others.

The implications of one’s digital footprint are significant, as they not only reflect personal interests and activities but also have a lasting presence. Employers may review digital footprints to assess potential hires, and personal information can be accessed by third parties, elevating privacy concerns. Understanding the scale and impact of these footprints is crucial, particularly when considering what happens to one’s data after their death.

Given the breadth of activities that contribute to a digital footprint, individuals should routinely evaluate their online presence. Being mindful of what information is shared and how it is disseminated has become a necessity in the digital age. This understanding serves not only to protect personal information but also to navigate the complexities of one’s digital legacy.

The Importance of Digital Estate Planning

In today’s increasingly digital world, the significance of digital estate planning cannot be overstated. As individuals accumulate various digital assets—ranging from social media accounts and digital photographs to online banking credentials and cryptocurrency—it becomes essential to consider how these assets will be managed after one’s death. Digital estate planning is the process of organizing and directing the management of these online assets to ensure that an individual’s wishes are fulfilled even when they are no longer present.

One of the first steps in effective digital estate planning is inventorying all digital assets. This process involves listing each account, the corresponding service providers, and login credentials. Creating a detailed record allows for easy access and management of these assets by designated heirs or executors. It is crucial to keep this inventory updated, as individuals frequently create new accounts or change passwords. Furthermore, employing password management tools can securely store and share this sensitive information.

Another vital aspect of digital estate planning is selecting a trusted individual to manage one’s digital assets after death. This trusted person, often referred to as a digital executor, should be informed about the individual’s wishes concerning data handling and should have access to the necessary credentials. Open discussions about digital assets and their management can lead to better compliance with one’s wishes and ease the burden on family members following a loss.

In addition, various service providers offer options for managing digital assets after death. These options may include legacy contacts for social media platforms, which allow designated individuals to manage accounts posthumously or delete them if necessary. By taking proactive steps in digital estate planning, individuals can ensure their digital legacies are treated with respect and dignity, ultimately alleviating potential disputes among surviving family members.

❤️ Powerful Real Love Spells That Work

Attract true love, reunite with your partner, and strengthen relationships with proven magic spells.

Assets and Their Management

As our lives increasingly shift to the digital realm, it is essential to recognize the various types of digital assets we accumulate. These digital assets can broadly be divided into several categories, including social media accounts, online banking profiles, emails, and digital subscriptions, each of which requires careful management to ensure they are properly handled following one’s death.

Social media accounts—such as Facebook, Instagram, and Twitter—often serve as a repository of cherished memories and connections. Therefore, it is crucial for individuals to determine how they wish these accounts to be treated posthumously. Many platforms have options for legacy contacts or digital heirs that allow appointed individuals to manage or memorialize the accounts, ensuring that the online legacy of the deceased is respected.

Online banking accounts also represent significant digital assets, requiring attention to their management. Heirs may need access to these accounts for estate settlement purposes. It is advisable to compile a list of all financial accounts, including banking, investment, and cryptocurrency wallets, and to store this information securely while providing access instructions to trusted individuals or legal representatives.

Additionally, emails are often overlooked as digital assets, containing critical correspondences and potentially sensitive information. Utilizing password management tools can facilitate the secure sharing or transfer of this information to designated heirs. Passwords and account credentials play a pivotal role in managing these digital assets, as they enable access to accounts and ensure that important documents and data are not lost.

Digital subscriptions, whether they pertain to services, streaming platforms, or digital libraries, can also be categorized as assets. The transferability of these accounts can vary widely based on the terms of service agreements. Therefore, it’s prudent to review the policies of each subscription to understand how to manage access after death.

In light of these considerations, proactive management of digital assets is essential to ensure that one’s online presence and proprietary data are preserved and utilized as intended following one’s passing.

Legal Perspectives on Digital Afterlife

The intersection of law and technology brings forth complex questions concerning the digital afterlife, particularly in relation to the management of digital assets after death. As assets increasingly exist in digital formats, legal frameworks must evolve to address the distribution of these digital resources. Currently, different jurisdictions employ varied regulations regarding the inheritance of digital assets, creating a patchwork legal landscape. In the United States, for instance, the Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) provides guidelines for how fiduciaries can access a deceased person’s digital accounts, enabling more streamlined navigation through one’s digital legacy.

Significant legal cases have emerged that further shape the discourse around digital inheritance. One notable case involved a deceased individual whose Facebook account was subject to dispute among family members. The court ultimately ruled in favor of the surviving family member wishing to access the account, thereby setting a precedent regarding the rights of beneficiaries to access digital content. Such occurrences highlight the importance of clear directives within wills, which can specify intentions regarding digital assets, including social media accounts, cryptocurrencies, and other online services.

Internationally, countries are also adapting their frameworks to manage digital inheritance. For example, in European jurisdictions, the General Data Protection Regulation (GDPR) plays a crucial role in defining how personal data can be handled post-mortem. Some regions have implemented laws that grant heirs access to a deceased individual’s digital files, ensuring that there are no hindrances in processing the digital estate. This evolving legislative approach underscores the necessity for individuals to consider their digital assets in estate planning, potentially appointing fiduciaries to manage and distribute these digital resources after their passing.

Social Media Policies on Deceased Users

Social media platforms have developed specific policies to address the handling of accounts belonging to deceased users. These policies aim to respect the wishes of the deceased while providing guidance to their families and friends on how to manage their digital presence. Major platforms like Facebook, Twitter, and Instagram each have their own procedures for dealing with such sensitive situations.

Explore Our Powerful Magic Spells

Choose a spell that suits your needs and experience real results today!

Facebook, one of the most widely used social media networks, offers a memorialization option for deceased users. When an account is memorialized, it serves as a place for friends and family to share memories and condolences. To initiate this process, a family member or friend must submit a request, providing the necessary documentation, such as a death certificate. Once memorialized, the account’s privacy settings are adjusted to protect the deceased’s information, and certain features, like login, are restricted.

Twitter, on the other hand, has a different approach. The platform allows for the deactivation of accounts upon request from an immediate family member. To facilitate the process, the requester needs to provide relevant information, including the deceased’s account details and their relationship to the deceased. Twitter does not provide a memorialization feature, so the account is entirely removed from the platform following a successful deactivation request.

Instagram follows a similar protocol as Facebook. The platform allows users to memorialize accounts, ensuring that they remain a space for recollection. Users can request memorialization by submitting a form along with proof of death. Instagram also gives options to remove the account upon request, similar to the procedures of Twitter. Each platform’s policies are designed to address the complexities of grief in the digital age while maintaining privacy and respect for the deceased’s wishes.

Creating a Digital Will: A Step-by-Step Guide

In our increasingly digital world, many individuals possess numerous online accounts, digital assets, and personal data that need to be managed in the event of their passing. A digital will serves as a legal document outlining how a person’s digital assets should be handled after their death. Creating a digital will ensures that your wishes are honored and can mitigate potential disputes among your survivors. Here’s a comprehensive guide on how to create one.

The first step in formulating a digital will is to catalogue all your digital assets. This includes social media accounts, email accounts, digital photographs, cryptocurrencies, and any online subscriptions or services you may use. Documenting each asset along with access information, such as passwords or recovery options, is critical. Tools such as password managers can assist in securely storing this information, ensuring it is easily accessible to your designated executor or trusted individual.

Next, consider drafting the actual document. While a legally binding will often requires specialized language, a digital will may be simpler. Start by specifying how you want each digital asset to be handled. For example, you may wish to specify that certain social media accounts be memorialized or that your online banking accounts be closed. Templates are available online to guide you in this process, offering a clear structure to address all pertinent issues.

Once your digital will is drafted, it is essential to share its existence and location with a trusted individual, such as a family member or lawyer. This transparency provides assurance that your wishes will be executed accordingly. Additionally, consider periodically reviewing and updating your digital will, particularly as your digital life evolves or as laws related to digital assets change. Creating a digital will is a valuable step in managing your legacy and ensuring your digital footprint is addressed according to your preferences.

Cultural and Ethical Implications

The phenomenon of digital death introduces a myriad of cultural and ethical implications as societies grapple with the intersection of technology and mortality. Different cultures have vastly differing views on death and the treatment of a deceased individual’s digital remains. For instance, in some traditions, there is a strong emphasis on commemorating the deceased; thus, digital assets such as social media profiles may be preserved as a testament to one’s life. In contrast, other cultures may perceive the preservation of digital identities as uncomfortable or even taboo, preferring to erase the digital footprint entirely.

The emotional aspects associated with digital remnants cannot be overlooked. Digital assets often serve as cherished memories, encapsulating moments of joy, interactions, and insights that were shared online. After the loss of a loved one, the existence of these digital reminders can evoke a complex mixture of emotions, from nostalgia and comfort to grief and discomfort. Family members may struggle with the desire to keep or delete these assets, highlighting the deep connection individuals have to their digital selves and the memories they encompass.

Ethically, the management of digital remains raises several dilemmas regarding data privacy and ownership. Who owns the digital assets after a person’s passing? Can family members access a loved one’s private messages or photos without consent? These questions challenge existing legal frameworks and prompt discussions about digital inheritance rights. Many digital service providers have policies regarding the handling of user accounts posthumously, yet these are often vague and differ across platforms. Such inconsistencies contribute to a growing discourse on the need for standardized protocols surrounding the treatment of digital legacies, thereby ensuring respect for both the deceased’s wishes and their family’s emotional needs.

Conclusion: Preparing for Your Digital Afterlife

As we navigate through an increasingly digital world, the concept of a digital afterlife has gained significant relevance. It is essential to understand that proactive management of one’s online presence is crucial for ensuring a respectful and organized transition of one’s digital legacy. In a time when our lives are intertwined with various online platforms, failing to address the implications of our digital footprints may lead to confusion and turmoil for our loved ones after we pass away.

Taking proactive steps involves evaluating all aspects of one’s digital life, including social media accounts, email addresses, and other data stored in cloud services. Individuals should consider creating a comprehensive digital will, which outlines the specific wishes regarding their online accounts and information. This not only addresses the management of your digital assets but also prevents potential conflicts among family members regarding access and ownership of your online accounts.

Additionally, informing trusted family members or designated representatives about your digital assets and your desired outcomes is a key component of effective planning. By sharing login details, access codes, and information about where your digital data is stored, you ensure that those you leave behind are equipped to handle your online affairs in accordance with your wishes.

Ultimately, the notion of preparing for a digital afterlife encapsulates more than mere account management; it emphasizes the significance of responsible stewardship of one’s digital legacy. Ignoring this aspect of modern legacy planning can have lasting repercussions on your loved ones during what is already a challenging time. By advocating for thoughtful preparations, you take meaningful steps towards ensuring that your online presence reflects your values and preferences even after your physical departure.